Cryptocurrency mining transforms computational power into digital currency through a process that functions as both transaction validator and monetary mint. Miners deploy specialized hardware—GPUs, ASICs, and increasingly sophisticated equipment—to solve cryptographic puzzles of staggering complexity, competing to validate blockchain transactions first and claim newly minted coins as rewards. This energy-intensive endeavor (consuming power rivaling entire nations) maintains network integrity while preventing double-spending, though most participants now join mining pools rather than brave solo ventures. The mechanics reveal deeper complexities worth exploring.

The digital age’s answer to medieval alchemy, cryptocurrency mining transforms computational power into digital gold through a process that would make Rube Goldberg proud in its byzantine complexity. At its essence, crypto mining validates transactions on blockchain networks while simultaneously minting new coins—a dual function that serves as both digital notary and monetary printing press.

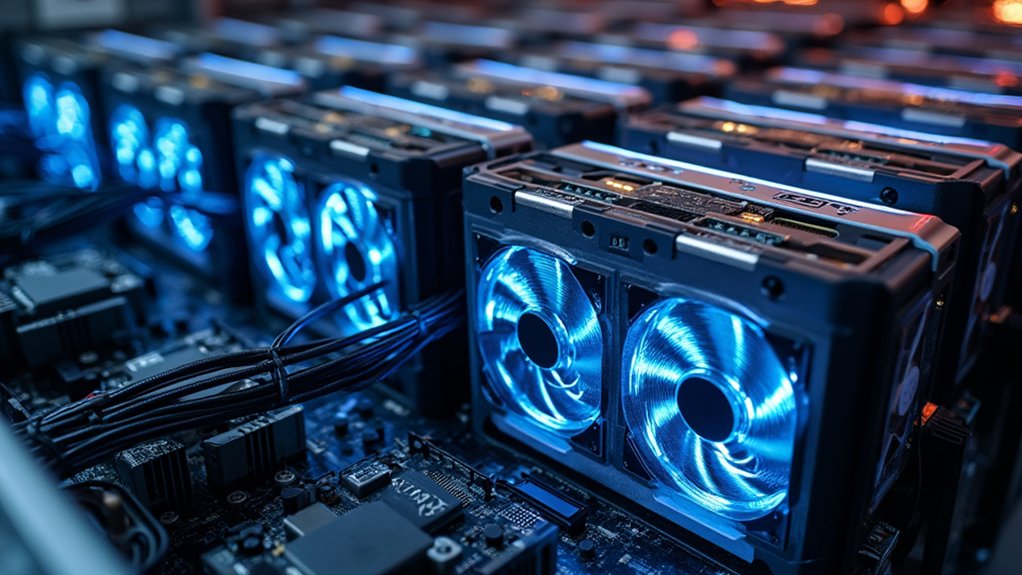

Miners deploy specialized hardware arsenals including GPUs, ASICs, and purpose-built SSDs to solve cryptographic puzzles of staggering computational complexity. These digital gladiators compete in a perpetual race to validate transaction blocks first, with victory bringing freshly minted cryptocurrency rewards plus transaction fees. The irony? This frenzied competition ultimately secures a system designed to eliminate the need for trusted intermediaries.

Digital warriors wielding silicon weapons race through cryptographic mazes, their competitive fury paradoxically birthing trustless harmony from computational chaos.

The validation process bundles transactions into blocks, organizing them through Merkle tree structures—mathematical constructs that would impress even the most pedantic computer scientist. Miners must solve hash puzzles linked to this transaction data, a task requiring computational brute force rather than elegant insight. Successfully solving these puzzles grants miners the privilege of adding their block to the blockchain, broadcasting their achievement across the network like a digital town crier.

Mining’s economic mechanics reveal fascinating market dynamics. During crypto’s halcyon days, GPU demand skyrocketed, transforming graphics card manufacturers like AMD into unlikely beneficiaries of digital currency fever. Mining difficulty adjusts algorithmically over time, maintaining equilibrium between coin issuance and network security—a feedback loop economists might admire for its elegant self-regulation. Each cryptographic hash produced generates a 64-digit hexadecimal number that miners must compare against the network’s target threshold.

The proof-of-work consensus mechanism underlying most mining operations demands enormous energy consumption, raising questions about sustainability that make environmental advocates wince. Yet this computational extravagance serves an essential purpose: preventing double-spending and maintaining blockchain integrity without centralized oversight. The environmental criticism stems largely from mining’s high energy consumption, which rivals the electricity usage of entire midsize countries. Managing this complex operation requires specialized mining software that controls hardware settings, monitors performance, and coordinates with mining pools to maximize efficiency.

Mining pools democratize participation by allowing individual miners to collaborate and share rewards, acknowledging that solo mining has become increasingly quixotic for all but the most well-capitalized participants. These collaborative arrangements distribute both computational load and financial returns, creating mining communities bound by cryptographic solidarity rather than geographical proximity.

Ultimately, crypto mining represents a fascinating intersection of technology, economics, and game theory—transforming electricity and silicon into decentralized monetary systems through sheer computational determination.

Frequently Asked Questions

How Much Money Can I Make From Crypto Mining?

Crypto mining earnings vary dramatically based on hardware efficiency, electricity costs, and market volatility.

With Bitcoin above $100,000, block rewards exceed $315,000—though individual miners capture minuscule fractions given the 500+ exahash global competition.

Small-scale operations often struggle with razor-thin margins unless accessing sub-$0.05/kWh electricity and sub-30 J/TH hardware.

Alternative cryptocurrencies may offer better opportunities, but profitability remains highly unpredictable and location-dependent.

What Equipment Do I Need to Start Mining Cryptocurrency?

Essential mining equipment includes ASIC miners (like Bitmain’s S21 Pro delivering 234 TH/s at 15 J/TH efficiency), mining software for pool connectivity, secure wallets for coin storage, and robust cooling systems—because overheated hardware yields zero returns.

Miners need dedicated electrical circuits handling 3,000-5,500W loads, high-speed internet, and proper ventilation.

GPU rigs remain viable for altcoins, though Bitcoin mining on consumer hardware is laughably obsolete given ASIC dominance.

How Much Electricity Does Crypto Mining Consume?

Cryptocurrency mining devours electricity with remarkable efficiency—Bitcoin alone consumes approximately 168 TWh annually by 2025, rivaling entire nations like Australia.

US operations account for 0.6-2.3% of national electricity usage, while Bitcoin represents 0.2-0.9% globally.

The 24/7 computational arms race drives continuous power consumption, as millions of mining rigs worldwide compete relentlessly.

Despite hardware efficiency improvements, total consumption escalates due to increasing mining difficulty—a deliciously counterintuitive economic phenomenon.

Is Crypto Mining Legal in My Country?

Crypto mining’s legality varies dramatically by jurisdiction—Kazakhstan welcomes miners with a modest 15% tax, while China has banned the practice entirely.

Belarus offers tax-free operations, Malta provides extensive regulatory frameworks, and countries like Colombia maintain ambiguous stances (financial institutions cannot engage with crypto, yet mining isn’t explicitly prohibited).

Given this patchwork of regulations, miners must navigate their specific country’s laws, which range from enthusiastic embrace to outright hostility.

How Long Does It Take to Mine One Bitcoin?

Mining one Bitcoin requires approximately 3.2 minutes—assuming complete network dominance, which remains laughably improbable.

Individual miners face stark reality: their minuscule hash rate fraction extends this timeframe dramatically. Current block rewards yield 3.125 BTC every ten minutes across the entire network, meaning solo miners might wait months or years depending on their computational power.

Pool mining offers more predictable returns, though participants receive proportional shares rather than full Bitcoin rewards.