While most family businesses concern themselves with traditional ventures like real estate or hospitality, the Trump dynasty has pivoted toward Bitcoin mining with the kind of enthusiasm typically reserved for campaign rallies. American Bitcoin, co-founded by Donald Trump Jr. and Eric Trump, recently secured $220 million through a private placement—a sum that would make even seasoned institutional investors pause and reconsider their allocation strategies.

The fundraising mechanics reveal institutional appetite for Bitcoin mining exposure, with 11 million shares issued to accommodate investor demand. Perhaps most telling is the $10 million contributed in Bitcoin rather than traditional fiat currency, suggesting participants possess sufficient conviction to part with actual cryptocurrency rather than merely writing checks. The Trump family maintains approximately 98% ownership post-merger, ensuring control remains concentrated despite external capital infusion.

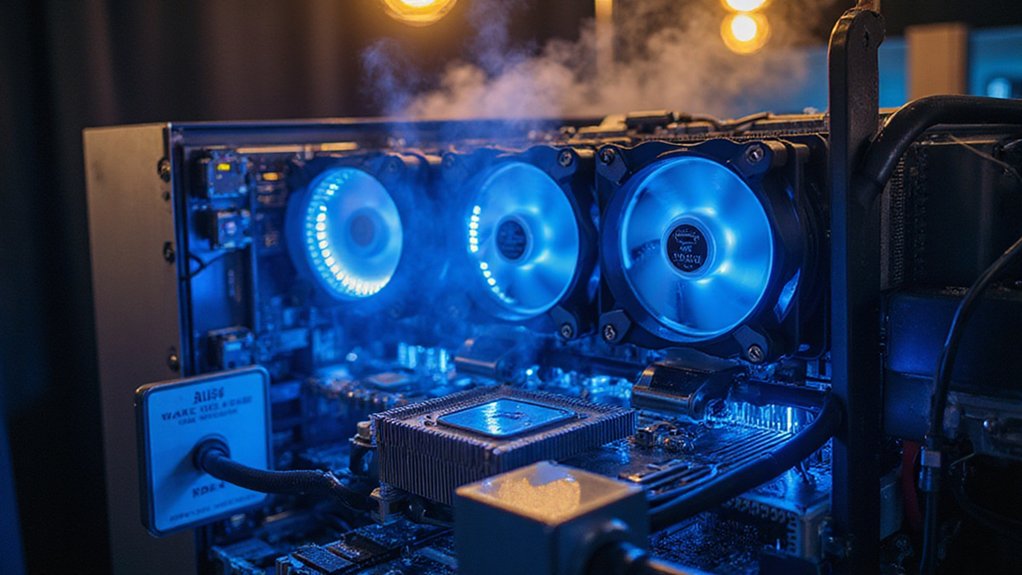

Donald Trump Jr. has publicly advocated for mining Bitcoin as superior to simple accumulation—a perspective that merits examination given mining’s operational complexity and capital intensity. The strategy involves purchasing industrial-scale equipment while simultaneously building Bitcoin reserves, with the company currently holding 215 BTC as of mid-June 2025. This dual approach fundamentally creates leveraged exposure to Bitcoin price movements while generating ongoing production capacity. Mining operations require miners to solve cryptographic puzzles by guessing nonce values until block hashes meet the network’s difficulty requirements, making it both computationally intensive and energy-consuming.

American Bitcoin operates under majority ownership by Hut 8 Corp, a publicly traded cryptocurrency mining firm that provides operational expertise and market credibility. The venture plans Nasdaq listing through merger with Gryphon Digital Mining, adopting ticker “ABTC” and targeting Q3 2025 completion. This public market access should facilitate future capital raises while maintaining family control.

The broader context reveals institutional confidence in Bitcoin mining amid cryptocurrency adoption acceleration. Hut 8’s separate Dubai expansion underscores geographic diversification strategies, leveraging favorable regulatory environments and tax structures. Dubai’s crypto-friendly jurisdiction offers operational advantages that domestic mining operations cannot replicate. The Dubai expansion represents Hut 8’s independent initiative to capitalize on the emirate’s supportive digital asset ecosystem and low-cost energy infrastructure.

The company launched in March with a focus on industrial-scale Bitcoin mining, establishing itself as a significant player in the rapidly evolving cryptocurrency sector. Whether this represents shrewd financial positioning or speculative excess remains debatable, though the fundraising success indicates market receptivity. The combination of Trump family branding, institutional backing, and Bitcoin’s persistent price appreciation creates compelling investment narrative—assuming mining economics continue supporting current valuations and operational assumptions prove accurate.