While most nations grapple with whether to embrace or exile cryptocurrency mining, Russia has characteristically opted for the bureaucratic middle path—comprehensive registration. The Ministry of Energy’s July 7, 2025 launch of a national cryptocurrency mining equipment registry represents Moscow’s attempt to transform an anarchic digital gold rush into a properly taxed, regulated industrial sector.

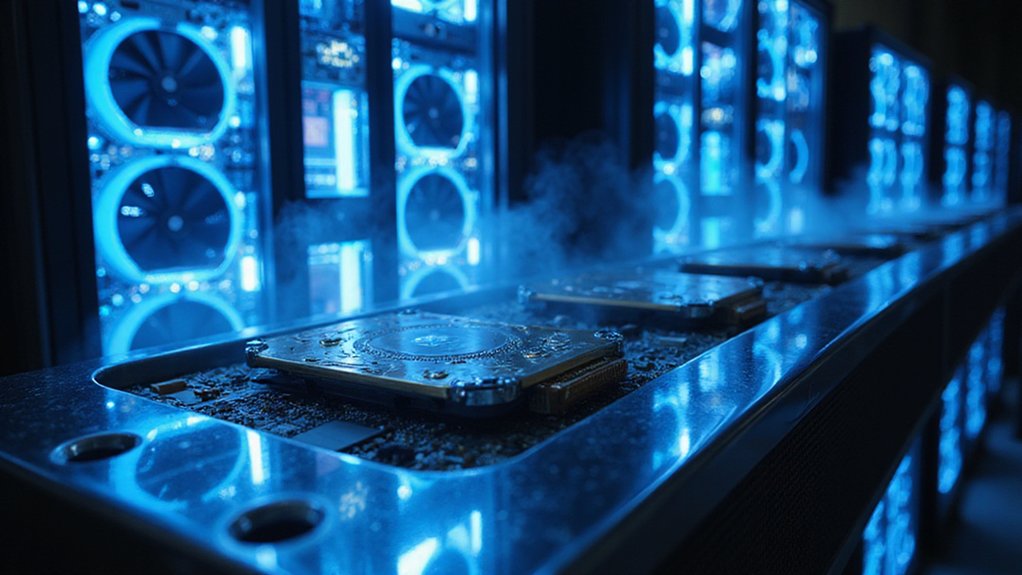

The registry, developed jointly by the Ministry of Energy, Federal Tax Service, and Ministry of Digital Development, requires miners to register equipment serial numbers and device models—creating what amounts to a digital fingerprint for every mining rig operating within Russian borders. This centralized database targets the twin problems of illegal electricity consumption and tax evasion that have plagued the sector since Bitcoin’s meteoric rise.

Russia’s mining registry creates digital fingerprints for every rig, targeting illegal electricity consumption and tax evasion through comprehensive equipment tracking.

Russia’s approach follows its summer 2024 legalization of cryptocurrency mining, which established frameworks requiring registration and taxation. The registry serves as enforcement mechanism for these regulations, particularly targeting operations that illegally tap power grids or exploit subsidized residential electricity rates. Deputy Minister Petr Konyushenko emphasized the registry’s role in stabilizing energy supply by curbing unauthorized consumption—a pressing concern given regional energy shortages caused by unregistered mining operations. The initiative comes as only 30% of miners have shown compliance with existing regulations, highlighting the enforcement challenge authorities face.

The initiative addresses substantial revenue losses to power distribution companies while recovering tax revenues previously lost to shadow operations. By enabling precise tracking of mining equipment, authorities can differentiate between legitimate businesses and illegal operations that have historically operated with impunity. The registry’s focus on equipment tracking becomes particularly crucial as mining operations increasingly rely on specialized ASIC miners and dedicated cooling systems that consume significant electrical resources.

Industry response suggests grudging acceptance of increased oversight, with mining operations continuing to grow despite regulatory burdens. Major service providers and data center firms are participating prominently in Russian mining forums, indicating sector maturation. The registry may paradoxically encourage investment by providing transparency and legitimacy that institutional investors typically demand.

Foreign interest remains strong, particularly from Chinese miners attracted by Russia’s cheap energy and bilateral cooperation agreements. While Russian law prohibits direct foreign establishment of mining operations, partnerships and investments persist through various structures. Chinese hardware manufacturers maintain substantial market presence, anticipating continued growth despite—or perhaps because of—the registry’s implementation.

This bureaucratic embrace of cryptocurrency mining reflects Russia’s broader strategy of regulatory capture rather than prohibition.