Proof of Work transforms cryptocurrency mining into an elaborate energy auction where computers race to solve cryptographic puzzles, with winners earning newly minted tokens and transaction fees. This consensus mechanism converts electricity into mathematical proof that transactions are legitimate, requiring miners to expend computational resources through SHA-256 hash functions while adjusting difficulty every 2,016 blocks. The system’s resource intensity creates security through economic deterrence—altering transaction history becomes prohibitively expensive, though critics question whether this energy expenditure justifies eliminating traditional financial intermediaries in favor of computational certainty over institutional promises.

The digital gold rush of the 21st century rests upon a foundation as elegantly simple as it is computationally brutal: Proof of Work, the consensus mechanism that transforms electricity into trust and processing power into monetary policy.

Bitcoin’s original architect understood that maintaining decentralized consensus without central authority required something more tangible than mere agreement—it demanded mathematical proof backed by genuine resource expenditure.

The mechanism operates through cryptographic puzzles that miners must solve using SHA-256 hash functions, fundamentally requiring participants to guess alphanumeric codes meeting specific network criteria. This computational lottery adjusts its difficulty every 2,016 blocks (approximately two weeks) to maintain consistent block production times, regardless of how many miners join the increasingly expensive competition.

The first miner to discover a valid hash below the target threshold broadcasts their solution for network-wide verification—a process that converts kilowatts into cryptocurrency with mechanical precision.

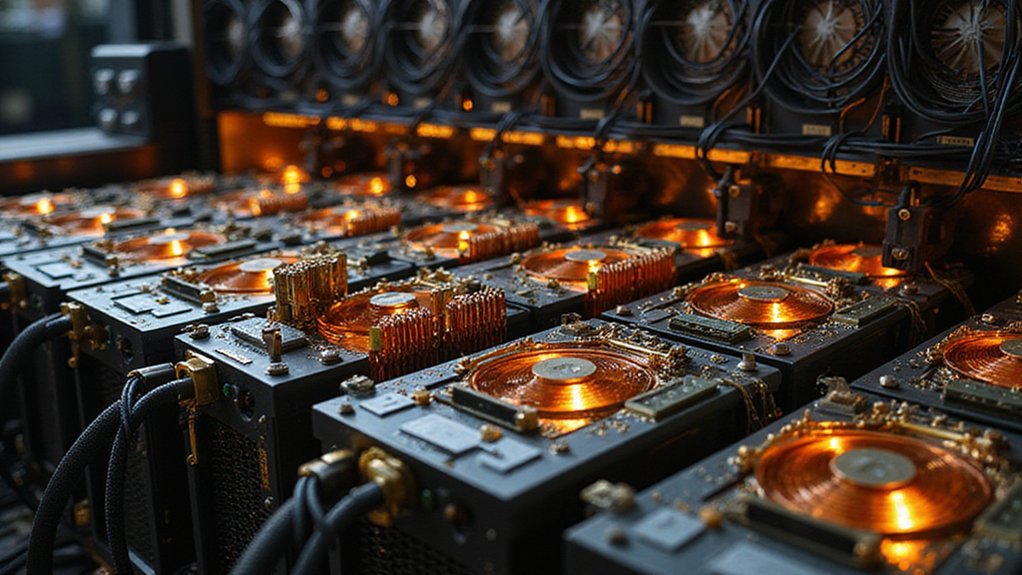

Miners serve as decentralized validators, transforming energy and specialized hardware into financial incentives through successful block proposals. Their compensation arrives via newly minted tokens and transaction fees, creating economic motivation for continued network maintenance. Modern mining operations often utilize specialized ASICs to maximize their computational efficiency and competitive advantage in the hash rate competition.

The beauty (and environmental controversy) lies in PoW’s resource intensity, which simultaneously secures the blockchain and deters malicious actors through sheer computational cost.

Security emerges from this expensive validation process, making transaction history alteration prohibitively costly while eliminating double-spending attempts through consensus verification. The continuous mining competition ensures no single entity can easily control the network—though the “easily” qualifier grows increasingly questionable as mining operations consolidate into industrial-scale enterprises. As cryptocurrency value increases, this mechanism naturally attracts more miners to the network, further enhancing its overall security.

The economic model incorporates predetermined reward halvings to control inflation, creating scarcity through algorithmic monetary policy rather than central bank decisions. This systematic reduction in block rewards forces miners to optimize efficiency or exit the market, resulting in what economists might recognize as a peculiar form of deflationary pressure built into the protocol itself. Each successful mining operation bundles transaction data into blocks that are cryptographically linked to previous blocks, forming an immutable chain that maintains network integrity.

Critics point to PoW’s substantial energy consumption as its Achilles heel, spurring development of alternative consensus mechanisms like Proof of Stake.

Yet proponents argue this energy expenditure represents the true cost of decentralized trust—a premium paid for eliminating traditional financial intermediaries through computational certainty rather than institutional promises.

Frequently Asked Questions

How Much Electricity Does Bitcoin Mining Consume Annually?

Bitcoin mining consumes approximately 175-200 terawatt-hours annually as of 2025, equivalent to entire nations like Australia or the Netherlands.

This translates to roughly $8.8 billion in electricity costs at prevailing rates, with operations drawing continuous power around 10 gigawatts globally.

While substantial, Bitcoin’s energy appetite now appears almost quaint compared to AI’s projected 23-gigawatt demand—a curious twist in the digital economy’s insatiable hunger for electrons.

Can Proof of Work Mining Be Profitable for Individual Miners?

Individual proof-of-work mining remains marginally profitable through strategic cryptocurrency selection and operational optimization.

While Bitcoin mining has become institutionalized (requiring substantial capital and cheap electricity), smaller miners can achieve modest returns by targeting energy-efficient alternatives like Kaspa or Ethereum Classic using GPU rigs.

Success depends on securing low-cost electricity, participating in mining pools, and carefully managing hardware depreciation—though profits often hover precariously above operational costs.

What Happens When All Bitcoin Blocks Are Mined?

When Bitcoin’s 21 million coin supply cap is reached around 2140, miners won’t simply pack up and leave—they’ll continue validating transactions and securing the network through proof-of-work consensus.

However, their compensation shifts entirely to transaction fees, creating an intriguing economic experiment: will user fees alone sustain mining profitability?

This change could reshape the mining landscape, potentially concentrating power among efficient operators while reinforcing Bitcoin’s deflationary monetary policy.

Which Cryptocurrencies Besides Bitcoin Use Proof of Work?

Several major cryptocurrencies employ proof-of-work consensus mechanisms beyond Bitcoin.

Litecoin (often called “digital silver”) processes transactions faster using similar mining principles.

Dogecoin—remarkably evolved from internet meme to legitimate payment method—maintains PoW security.

Bitcoin Cash, the contentious 2017 fork, preserves original Bitcoin’s consensus model.

Ethereum Classic stubbornly retained PoW after Ethereum’s shift to proof-of-stake.

Privacy-focused coins like Monero and Zcash also utilize computational mining for blockchain validation.

How Long Does It Take to Mine One Bitcoin Block?

Bitcoin blocks maintain a remarkably consistent 10-minute mining target through an ingenious difficulty adjustment mechanism that recalibrates every 2,016 blocks.

While actual times fluctuate around 9.97 minutes currently, the network’s self-regulating algorithm guarantees miners—regardless of their collective computational firepower—cannot permanently accelerate this pace.

This temporal precision remains unaffected by halvings or market volatility, creating Bitcoin’s predictable monetary issuance schedule extending until approximately 2140.