While cryptocurrency markets have certainly seen their share of dramatic swings, the latest surge in mining stocks suggests that investors have developed an almost Pavlovian response to rising Bitcoin prices—and early 2025 has provided plenty of stimulus for such conditioning. Riot Platforms jumped 17.53% while Hut 8 climbed 14.2%, demonstrating how quickly market sentiment can translate into tangible gains for those willing to bet on digital pickaxes rather than the gold itself.

The standout performer remains CleanSpark, whose 120% revenue surge to $162.3 million in Q1 2025 accompanied by net income of $241.7 million suggests that sometimes the most profitable approach to cryptocurrency involves avoiding the trading entirely. The company’s adjusted EBITDA leap from $25 million to $245.8 million year-over-year represents the kind of growth that makes traditional investors wonder if they’ve been overthinking this whole “fundamentals” concept.

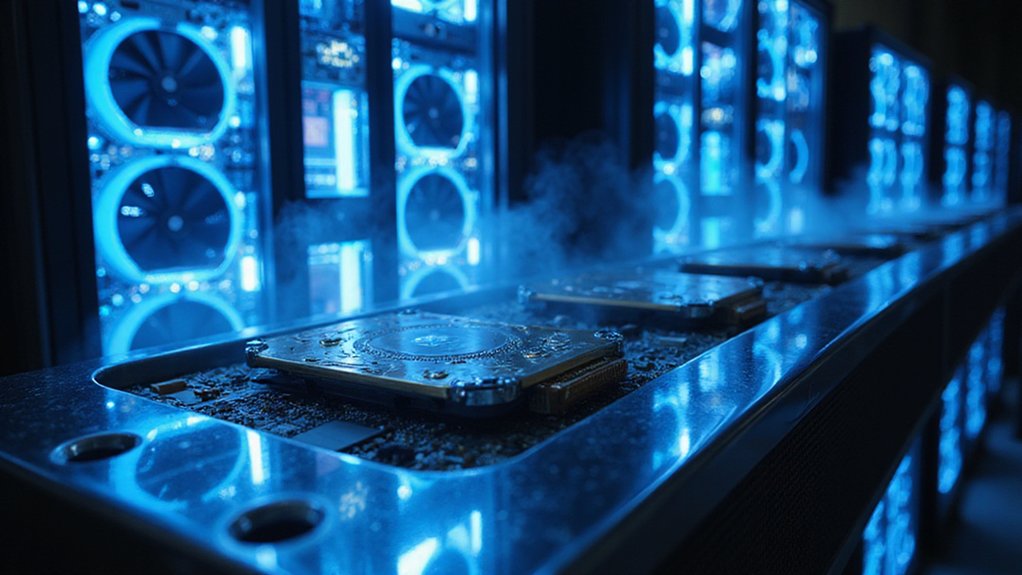

What’s particularly remarkable is the operational expansion underlying these financial metrics. CleanSpark’s hash rate expansion from 10 EH/s to over 37.5 EH/s throughout 2024 demonstrates how quickly mining infrastructure can scale when capital flows freely. Meanwhile, Cipher Mining’s targeting of 13.5 EH/s with plans to reach 35 EH/s using Canaan A1566 miners, and Core Scientific’s operation of 164,000 miners generating 19.1 EH/s, illustrate an industry-wide arms race in computational power. This mining expansion reflects how companies with strong balance sheets are positioned for significant valuation increases as they scale their operations aggressively.

The cryptocurrency mining sector’s computational arms race reveals how rapidly infrastructure can expand when capital markets embrace digital gold rush economics.

The sustainability narrative adds another layer of complexity—CleanSpark’s integration of solar and wind power sources, along with Cipher Mining’s renewable energy focus, suggests that environmental concerns have evolved from regulatory headaches into competitive advantages. Hut 8’s impressive energy efficiency improvements, reducing costs per MWh to mine Bitcoin to $28.83—a 33% reduction—underscore how operational optimization can directly impact profitability margins. For investors seeking alternative approaches to crypto exposure, staking rewards through proof-of-stake networks offer another pathway to earn returns without the energy-intensive requirements of traditional mining operations. Whether this represents genuine environmental stewardship or shrewd marketing positioning remains to be seen.

Perhaps most intriguingly, Core Scientific’s pivot toward AI workloads—aiming for equal operational split between crypto mining and artificial intelligence by 2025—reflects a pragmatic acknowledgment that diversification might be prudent when your primary revenue stream depends on digital assets that can lose half their value over lunch.

The company’s $460 million convertible note raise, despite posting a $455.3 million net loss, demonstrates that capital markets remain remarkably forgiving when growth stories sound sufficiently compelling.