Despite the cryptocurrency sector‘s notorious volatility and the perpetual chorus of skeptics declaring Bitcoin mining dead with each market downturn, the industry continues its relentless march toward profitability in 2025—generating approximately $20 million worth of Bitcoin daily, or roughly $600 million monthly, figures that would make even traditional mining conglomerates pause with grudging respect.

Against this backdrop of industrial-scale operations dominating the landscape, a solo miner recently demonstrated that David occasionally still defeats Goliath, securing a $350,000 windfall with a modest 2.3 petahash operation. The achievement becomes particularly remarkable when considering that this individual’s computing power represents a microscopic fraction of the global network’s 831 EH/s hashrate—roughly equivalent to bringing a pocket calculator to a supercomputer convention.

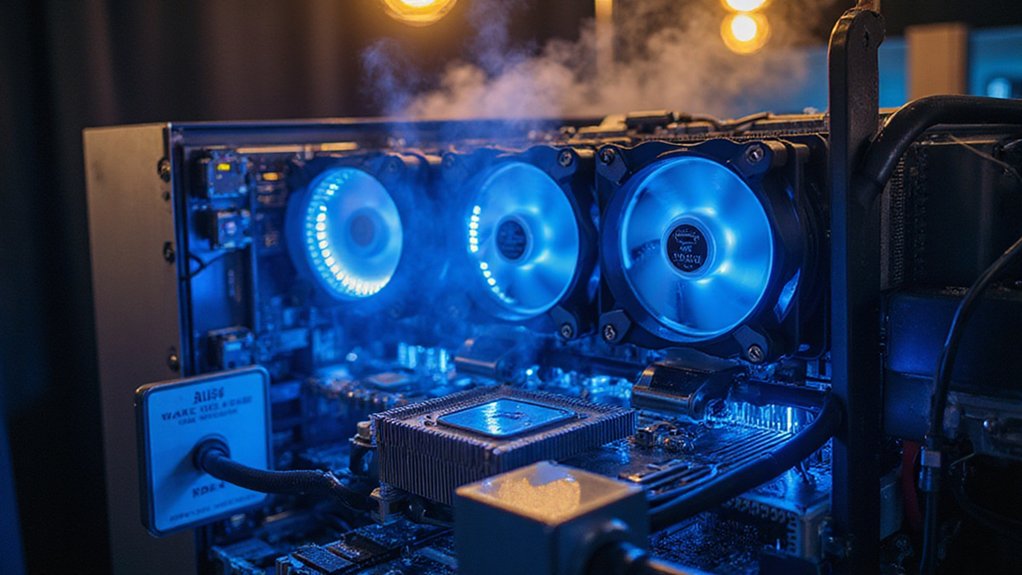

The mathematics underlying this victory illuminate mining’s inherent lottery dynamics. With current block rewards standing at 3.125 BTC and Bitcoin prices supporting such substantial payouts, solo miners face astronomical odds that would make Las Vegas bookmakers weep with envy. The global network’s computational intensity has reached peaks near 921 EH/s, creating a competitive environment where timing and efficiency alignment become vital factors separating profitable operations from expensive space heaters.

Mining profitability in 2025 depends heavily on electricity costs, which range from subsidized rates of $0.035 per kWh in regions like Oman to punitive industrial rates elsewhere. This solo miner’s success story likely required strategic geographic positioning and operational efficiency—factors that separate hobbyist dreams from profitable reality. Historical data tracking Bitcoin mining revenue from July 2010 reveals the industry’s remarkable evolution over nearly fifteen years.

The broader industry context makes this achievement even more significant. North American operations contribute 26.3% of global hash power, while institutional players pursue massive expansion plans following May 2025’s nearly 20% revenue increase. Advanced hardware costs have plummeted from $80 per terahash in 2022 to approximately $16 today, democratizing access but intensifying competition. Modern mining operations increasingly rely on specialized ASICs to maintain competitive hash rates in this energy-intensive environment.

With the next halving scheduled for 2028, reducing block rewards to 1.5625 BTC, such solo mining victories may become increasingly rare. The industry’s relentless efficiency improvements and rising difficulty adjustments continue reshaping mining economics, making this $350,000 strike a potentially endangered species in the cryptocurrency ecosystem’s evolutionary trajectory.